Home : Research Results : DIR could stop 39% of Aucklanders buying a dwelling

Research Results

DIR could stop 39% of Aucklanders buying a dwelling

6 Jul 17

39% of Aucklanders think they will not be able to buy homes if the Government gives the Reserve Bank a new power and home lending is limited to five times household income.

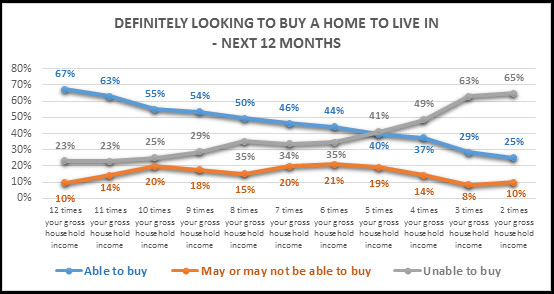

Horizon Research finds the preferred debt to income ratio (DIR) of five favoured by the bank in a recent report is the ratio at which those who could probably or easily buy a dwelling (40%) matches the percentage who would find it difficult or would definitely not be able to buy (41%).

The other 19% say “I might be able to buy but might not be able to” in a survey by Horizon Research.

At a DIR of five, in Auckland, 27% said they might or might not be able to buy, 33% felt they could still buy and 39% said they would not be able to.

It also appears that those looking to buy a home to live in, especially in Auckland, believe they would be more affected by Debt to Income ratio controls than those looking to buy an investment property. Putting DIR controls in place could see about 15,000 adults, or 6% of “definite buyers” leave the market.

For those looking to sell an existing house and buy a new one, it could mean an inability to buy, resulting in fewer definite sellers actually put their properties up for sale.

Results are reported for two nationwide surveys of the adult population in July 2016, covering the potential impacts of Loan to Value and Debt to Income ratio policy options.

Samples sizes were 2181 and 2177. At a 95% confidence level, the maximum margin of error for each survey is +/- 2.1%.

Respondents were asked how they would be impacted if the Reserve Bank introduced Debt to Income ratios for mortgage lending (this survey did not ask questions on specific DIR levels).

- 6% of those who were definitely looking to buy a dwelling in the next 12 months (both nationally and in Auckland) said they would not buy. That is equivalent to 15,000 people 18+ nationally and 6,900 in Auckland.

- However, it appears that those looking to buy a home to live in, especially in Auckland, believe they would be more affected by Debt to Income ratio controls than those looking to buy an investment property.

- 33% nationally and 13% of Aucklanders looking to buy a home to live in and not an investment property said they would still be able to buy if Debt to Income ratio controls were put in place.

- By comparison, 43% of those looking to buy an investment property said they would still buy if Debt to Income controls were in place; among Auckland investment buyers 33% would still buy.

Respondents were asked what they thought the overall impact would be if the Reserve Bank put in place Debt to Income ratios for mortgage lending.

- The majority of respondents, both nationally and in Auckland, thought the strongest overall impact would be that fewer people would be able to buy residential property and secondly, ordinary New Zealanders would not be able to buy residential property.

The Reserve Bank has since publicly discussed a DIR of 5. It says this may reduce the risk of a housing crash. However, at a DIR of 5 significant numbers of buyers could leave the market.

At a ratio of 5, Horizon finds:

- Demand drops below supply if you only include those who feel they will still be able to buy. If current property owners are unable to buy a new properties, they may well not sell, resulting in supply potentially tightening further.

- Auckland buyers are affected much more than buyers outside Auckland. 31% of those looking to buy in Auckland would still be able to buy versus 46% outside Auckland.

- 51% of investors outside Auckland will still be able to buy investment properties. Only 18% of Aucklanders looking for an investment property investors said they would still be able to buy, which may force them to look outside Auckland and put more pressure on other areas.

- In terms of household income, the balance point household income range where equal numbers of people will be able to buy and not able to buy is $70k- $100k or more to be able to buy.

- The impact is not age related.

The research was conducted in the public interest by Horizon, was subsequently purchased by a national economics consultancy and, along with any update, is available for purchase by others.

For further information please contact:

Grant McInman, Manager, Horizon Research

E-mail: gmcinman@horizonresearch.co.nz

Telephone: +62 21 076 2040

HorizonPoll Online Survey system

and website developed by BEWEB

Copyright © 2010. HorizonPoll incorporating ShapeNZ - Listening to New Zealand