News

Strong support for beefing up KiwiSaver

7 Sep 17

New research of over 2000 New Zealanders released at the Financial Services Council’s annual conference shows there is overwhelming public support for strengthening KiwiSaver and improving Kiwis access to the savings scheme.

The findings show that New Zealanders across the board want KiwiSaver to be beefed up including more options for how they contribute to and access their KiwiSaver schemes.

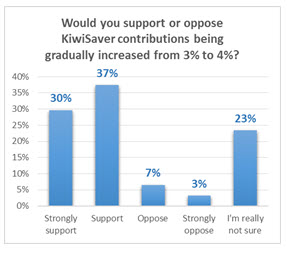

67% of those surveyed supported increasing both employer and employee contributions increasing gradually from 3% to 4% by 2021.

The poll also showed that despite concerns about an increased contribution rate costing employers, a majority of business executives, managers, business proprietors and self-employed people support a gradual increase to 4%.

“After ten years of KiwiSaver we are maturing in our understanding and appreciation of the scheme. Given the universal support this research shows we now need to have a constructive policy debate on contribution levels and how we can increase them in a sustainable manner,” said Richard Klipin, CEO of the Financial Services Council.

“With support for strengthening KiwiSaver so high there is a clear challenge for our political leaders two weeks out from the election to show their roadmap for backing what voters want and growing KiwiSaver.

“It is important that these findings are given serious consideration at policy level.”

A clear majority of respondents also wanted the ability to choose automatic increases in contribution rates and to have extra choices to increase contributions.

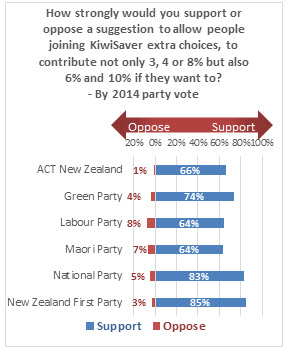

Having extra choices for KiwiSaver contribution rates was backed by voters for all parties with 83% of National voters, 64% of Labour voters, 85% of NZ First and 74% of Green voters in favour.

The research also reflects Kiwis’ changing altitudes to work and retirement with the majority of respondents supporting letting those who were 65 years and over join KiwiSaver and decoupling KiwiSaver access from pension age.

Over 2.6 million New Zealanders are now signed up and more than $40 billion is under management in KiwiSaver funds.

“The research provides an opportunity to understand New Zealanders views on the KiwiSaver scheme and how they want it to evolve. It’s now up to industry and Government to take the findings on board and work to improve KiwiSaver,” Mr Klipin concluded.

The report, ‘Growing the KiwiSaver Pie’ is the first of three pieces of research commissioned by the Financial Services Council on KiwiSaver and carried out by Horizon Research. It is one of the largest ever undertaken on New Zealanders views on KiwiSaver.

Summary of results

1. Increasing contributions from 3% to 4% by 2021

67% of adults supported gradually increasing contributions to KiwiSaver by both the employee and employer from 3% to 4%. 10% opposed the idea, while 23% were not sure.

Increasing contributions was backed by backed by voters of all parties with 79% of National voters, 60% of Labour voters, 73% of NZ First and 66% of Green voters in favour.

2. Choosing automatic increases

Support was strong for a recommendation to allow KiwiSaver members to choose an automated annual increase in their contribution rate of 0.25%, 0.5% or 1% up to a capped maximum rate.

63% of respondents supported the idea of automatic increases while 9% opposed it. 28% were not sure.

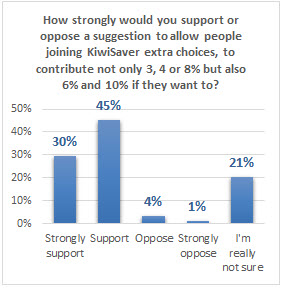

3. Extra choices to increase contributions

Support for allowing people joining KiwiSaver to contribute not only 3, 4 or 8%, as is the case now, but also choose 6% or 10% is very strongly supported.

75% approve of this policy change idea, while just 5% oppose (only 1% strongly oppose). 21% are not sure.

4. Decoupling KiwiSaver funds access from pension age:

There was majority support for uncoupling the age at which people can access their KiwiSaver funds from the age at which they become eligible for the New Zealand Superannuation pension. Some 51% supported this idea. More people were uncertain (31%) than opposed (19%).

5. Reapplying to maintain a “contributions holiday”:

Respondents were asked if they supported or opposed a proposal to help ensure people are saving as much as possible – by having them reapply each year to continue a “contributions holiday”- up to a maximum contributions holiday period of 5 years. 53% support this, 16% oppose and 31% are unsure.

6. Let those 65+ join KiwiSaver:

Respondents were asked if those aged 65+ who are still working should be able to join KiwiSaver and enjoy the same benefits as those aged under 65, including employer and government contributions. 66% said yes, 13% oppose and 22% were unsure.

7. Forecasting how much KiwiSaver members could have:

Some Government officials have started work on a possible policy which would require KiwiSaver providers to give savers forecasts each year of how much their retirement balance could be once they turn 65 (if they continue to save at the same rate and stay in the same fund). This idea has strong support: 70% support, just 6% oppose and 24% were not sure.

Download the full report here. (PDF file).

Method and sample:

2,199 adult respondents responded to the survey between 3 and 16 March 2017.

The sample used source diversity, with a total of 2,082 respondents: 1,946 members of Horizon Research’s national online research panels, plus 253 respondents provided by an online sampling and data collection company. Horizon’s panels and the external panel have been recruited and maintained to represent the New Zealand population.

The sample was weighted to match national demographics for age, gender, personal income, education level, and employment status at the 2013 Census and party vote at the 2014 general election. The survey has an overall margin of error of ±2.1%.

For further informtion please contact Grant McInman, Manager, Horizon Research, e-mail gmcinman@horizonresearch.co.nz, telephone +64 21 076 2040.

HorizonPoll Online Survey system

and website developed by BEWEB

Copyright © 2010. HorizonPoll incorporating ShapeNZ - Listening to New Zealand