Home : Research Results : 44% for capital gains tax, 35% against overall

Research Results

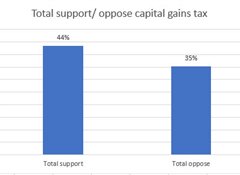

44% for capital gains tax, 35% against overall

28 Mar 19

44% of new Zealand adults support introducing a capital gains tax. 35% oppose.

A Horizon Research February 28-March 15, 2019 nationwide poll finds 16% are neutral on a new tax, while 6% do not know.

However, while overall support is higher, opposition to a new tax is extremely high among voters for National, ACT and New Zealand First (NZF), indicating the strength of sentiment the governing coalition will need to manage if NZF is to support some form of tax change.

Opposition is also very high among National voters (62% oppose, 23% support). ACT voters are 86% against and none are for it. Among NZF 55% oppose, 30% support, while 15% are neutral.

A new tax is well supported by Green Party voters (75% for,14% against), Labour voters (60% for,14% against), Opportunities Party voters (58% for, 26% against) and those who chose not to vote in 2017 (44% for, 6% against).

Asset owners strongly oppose

The survey also measured what types of assets New Zealanders owned, and their support or opposition to introducing the new tax.

Among those with assets, on which a tax has been suggested on capital gains made after 1April, 2021, opposition is mostly extremely strong.

Opposition and support by asset type owned are:

- Shares in companies: 56% oppose, 34% support

- Bonds and debentures: 39% support, 40% oppose

- Holiday home (not home lived in) without a mortgage: 67% oppose, 29% support

- Holiday home (not home lived in) owned with a mortgage: 47% oppose, 42% support

- Farm, lifestyle property (more than 1 hectare) with a mortgage: 90% oppose, 10% support

- Farm, lifestyle property (more than 1 hectare) with a mortgage: 50%% support, 50% oppose

- Residential rental/ investment property without a mortgage: 66% oppose, 29% support

- Residential rental/ investment property with a mortgage: 74% oppose, 24% support

- Commercial/ rental investment property without a mortgage: 51% oppose, 49% support

- Commercial/ rental investment property with a mortgage: 74% oppose, 24% support

- Beneficiaries of trusts that own residential rental properties: 60% oppose, 30% support

- Beneficiaries of trusts owning commercial property: 67% oppose, 27% support.

Even among those who own their own homes, which won't be affected by a gains tax under suggested reforms, opposition is higher than support:

- Own my own home without a mortgage: 49% oppose, 36% support

- Own my own home with a mortgage: 47% oppose, 42% support.

Managing support and opposition by likelihood to vote:

One of the potential hurdles for the government in passing a law introducing a capital gains tax but delaying its start date until after the 2020 general election, are the likely stances taken by those who are more likely to actually cast votes, based on results of recent elections.

The number who own assets likely to be affected by taxing any gains made after 1 April 2021 is relatively smaller compared with the adult population overall. For example, the results indicate 3% of adults own a holiday property they do not live in, around 95,960 of the country's 3,198,960 adults. A similar number own lifestyle properties and around 607,802 own shares in companies, 348,369 of whom oppose a gains tax and 218,815 support it.

However, many who strongly supported National in 2017 oppose a new gains tax and are likely to turn out to vote more than some others who support a gains tax, based on past voting behaviour.

Among those aged 55+, who are more likely on average to vote than adults overall, more oppose than support the introduction of capital gains tax.

Among 55-64 year-olds opposition is at 43% (support 38%), 65-74 year-olds 46% support, 37% oppose) and among those aged 75and older 47% oppose, 38% support.

Highest support by age is among those aged 35-44 years: 51% support, 34% oppose.

Occupations for and against:

In what is most likely a reflection of party voting tendencies, incomes and asset ownership, opposition is extremely high among some occupational groups:

- Business managers/ executives: 82% oppose, 15% support

- Farm owners/ managers: 95% oppose, 5% support

- Retired/ superannuitants: 49% oppose, 38% support.

In other occupations there is more support than opposition:

- Professionals and senior government officials: 86% support, 22% oppose

- Teachers, nurses, police and other trained service workers: 57% support, 18% oppose

- Technical, mechanical, skilled workers: 44% support, 40% oppose

- Homemakers not otherwise employed: 47% support, 25% oppose.

Questions and methodology:

The survey has 1,116 respondents aged 18+ and was undertaken between February 27 and March 15, 2019. Results are weighted to ensure the sample presents the New Zealand adult population at the 2013 census. At a 95% confidence level, the maximum margin of error is +/- 2.9%.

Media coverage and commentary:

NewsroomPro -Old landlords versus young renters

The New Zealand Herald - "Turkeys don't vote for Christmas"

HorizonPoll Online Survey system

and website developed by BEWEB

Copyright © 2010. HorizonPoll incorporating ShapeNZ - Listening to New Zealand