Home : Research Results : 79,000 Kiwis worry higher interest rates may force dwelling sale

Research Results

79,000 Kiwis worry higher interest rates may force dwelling sale

18 Aug 22

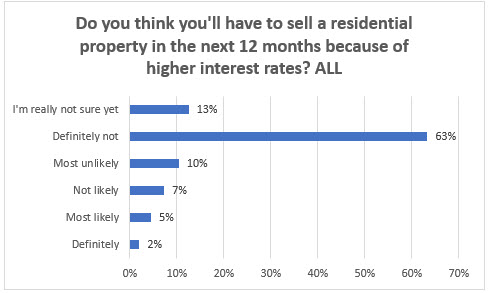

A Horizon poll finds 2% of the country’s adults think they will “definitely” have to sell a dwelling in the coming year because of higher interest rates.

This equates to around 79,000 adults living in an estimated 37,788 homes.

Another 5% are worried a sale is “most likely”. However, Horizon says “definite” intentions most often reflect actual behaviour.

Horizon says the results of the August nationwide survey of 1,065 adults shows the depth of concern being generated by a series of interest rate rises, aimed at helping control inflation. People were asked what they thought might happen, not what they would definitely be doing.

Those who most think they’ll definitely have to sell a dwelling are aged 35-44 years.

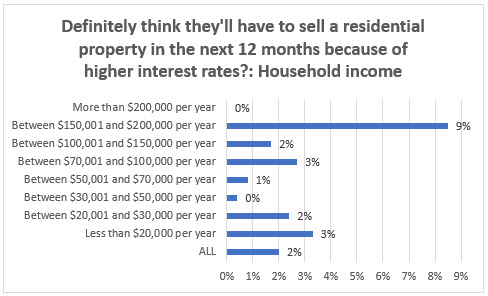

Those most worried include those in households with:

- Incomes between $150,000 and $200,000 a year are most worried: 9% definitely think they may have to sell a dwelling, compared with 2% overall

- Two parents and one or two children at home, and

- Business managers, executives 9%,

- Business proprietors and self-employed: 7%

Some sales could be of investment dwellings, and the survey indicates that around 19% of those who think they might have to sell are definitely thinking of buying another dwelling in the coming year.

Demand still exceeding supply:

However, Horizon says overall demand for homes is still expected to exceed supply in the coming year.

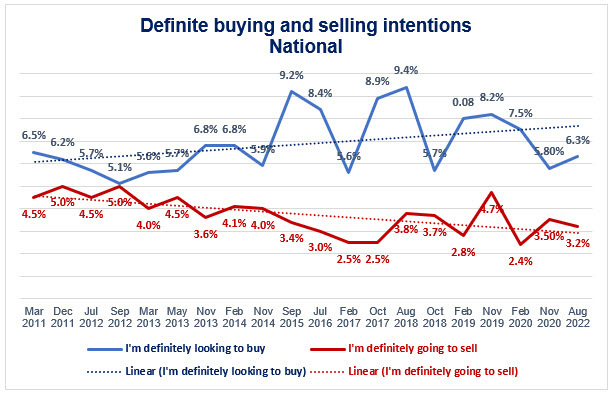

The company has been projecting the number of “definite sellers and “definite buyers” since March 2011.

6.3% of respondents reported they were definitely looking to buy in the next 12 months, which is slightly up from 5.8% in November 2020 but a drop from 8.2% in November 2019.

3.2% of respondents said they were definitely looking to sell in the next 12 months.

The gap between supply (definitely sell) and demand (definitely buy) is increasing and is around 58,200 dwellings nationwide.

This indicates the rate of sales could be driven by other activity, like mortgage approvals, affordability, and demand from new migrants who have residency.

Methodology:

The online survey of 1,065 respondents aged 18+ was conducted between July 29 and August 3, 2022.It is weighted by age, gender, personal income, ethnicity, education level and region to provide a representative sample of the adult population based on StatsNZ census updates. At a 95% confidence level, the maximum margin of error overall is +/- 3%.

The question on interest rate rises likely to result on dwelling sales was not conducted a client and is published by Horizon in the public interest.

For further information please contact:

Graeme Colman, Principal, Horizon Research, E-mail gcolman@horizonresearch.co.nz, Telephone 021 848 576.

HorizonPoll Online Survey system

and website developed by BEWEB

Copyright © 2010. HorizonPoll incorporating ShapeNZ - Listening to New Zealand