News

43,000 fear higher interest rates may force property sale

6 Jul 23

A Horizon Research Banking Monitor finds 3% of adults think they might have to definitely sell a property in the next 12 months because of higher interest rates.

That’s equivalent to 43,000 people with a mortgage.

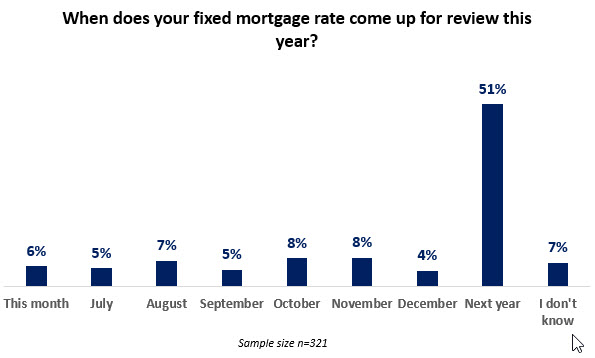

49% of those with a mortgage say their interest rates are being reviewed between June and December this year. The highest months for renewals are October and November (each 8%).

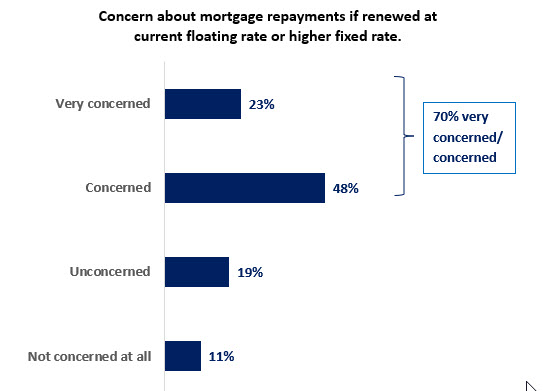

Mortgage stress levels are running high: 70% of adults with a mortgage are concerned they pay not be able to afford payments if they have to renew at current or higher fixed rates.

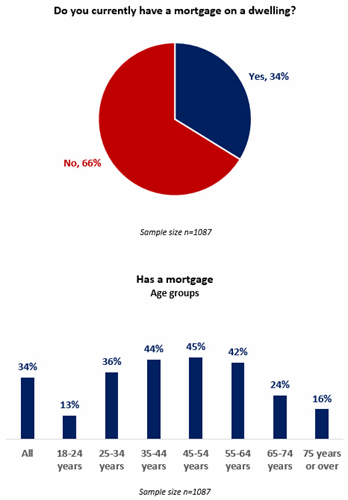

Who has mortgages

The Banking Monitor, surveying1,091 adults between June 8 and 12, finds:

- 34% of respondents (1,341,000 adults) currently have a mortgage on a dwelling.

- 44% of 35-54 year olds have a mortgage.

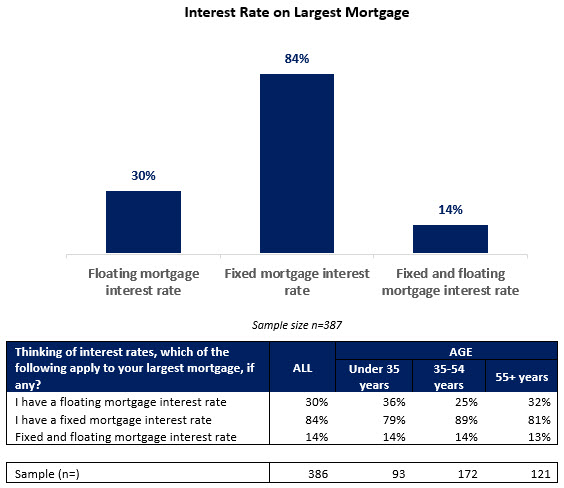

- 84% (1,125,000 adults) have a fixed mortgage on their largest mortgage, 30% a floating rate and 14% both fixed and floating.

Timing of interest rate reviews

30% of fixed mortgage holders say interest rate reviews are due between June and October 2023. 51% of reviews occur next year (2024).

Mortgage stress

Respondents were asked: “If your mortgage is renewed at the current floating rate, or a higher fixed rate, are you concerned you may not be able to afford the repayments?”

- 70% of mortgage holders (940,000 adults) said they were very concerned/concerned and they may not be able to afford the repayments. Of these

- 23% (303,000 adults) of mortgage holders were very concerned.

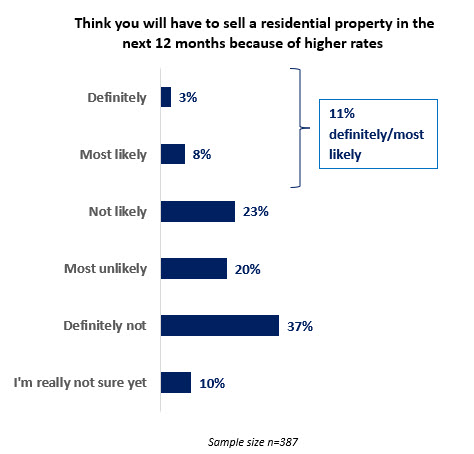

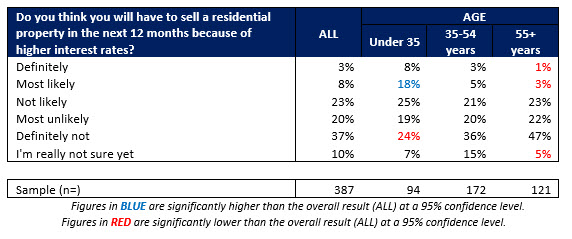

Feared sale because of higher interest rates

Many fear they might have to sell in the next year because of higher interest rates.

Respondents were asked “Do you think you will have to sell a residential property in the next 12 months because of higher interest rates?”

- 3% thought they might definitely have to sell in the next 12 months. This equates to 43,000 people with a mortgage.

- 8% fear they most likely will have to sell. This equates to 100,000 people with a mortgage.

37% say they definitely do not have to sell in the next 12 months.

Similar to overall concern, there are differences across age groups with 26% of under 35s saying they definitely/most likely to have to sell in the next 12 months.

People aged 55+ are the least likely to have to sell with only 4% saying they definitely/most likely to have to sell in the next 12 months.

Sample

Results are from a Horizon Research Banking Monitor survey conducted between 8 and 12 June 2023. The total sample size was 1,091 adults, 18 years of age and over.

Respondents were from Horizon’s two specialist online research panels (general and Māori populations 18+) and third party research panel for source diversity.

The maximum margin of error is ±3% (at the 95% confidence level). The data was weighted on age, education, ethnicity, gender and region to be representative of the adult New Zealand population.

The Banking Monitor measures mortgage stress, and how banks used by adults and how rate the performance of their main mains on 16 key service and reputation factors.

Contact:

For further information please contact

Graeme Colman, Principal, Horizon Research, email gcolman@horizonresearch.co.nz; telephone +64 21 848 576

Julia Ord, Manager, Horizon Research, email Julia.ord@horizonresearch.co.nz; telephone +64 27 706 8790

HorizonPoll Online Survey system

and website developed by BEWEB

Copyright © 2010. HorizonPoll incorporating ShapeNZ - Listening to New Zealand