Home : Research Results : 68% say make banks offer fraud protection

Research Results

68% say make banks offer fraud protection

14 Apr 24

68% (2,785,000 adults) believe the government should regulate to make sure banks offer fraud and cybercrime protection to customers.

These are among findings of a new study, conducted in the public interest by Horizon Research, on bank fraud and cybercrime. It finds a significant number of adults have experienced fraud and theft via their bank accounts or cards in the past 12 months:

- 12% (512,000 adults aged 18+) have had someone use a bank card, credit card, cheque or other document, without permission, to commit fraud and/or steal from them

- 9% (376,000) have experienced fraud, theft involving a bank account

- 6% (243,000) have been a victim of cybercrime, with an internet device accessed without permission.

Of those who were victims of fraud, 78% lost up to $5,000.

- 51% of them lost up to $500.

Regulate: Don't leave it to the banks

The Financial Markets Authority will become the “conduct” regulator for banks in 2025. The aim is to make sure banks and others treat customers fairly.

86% (3,540,000 adults) believe the Financial Markets Authority should regulate to make sure banks provide minimum fraud protection for customers.

Create a new police-run anti-fraud and cybercrime centre

New Zealanders strongly support a range of efforts to tackle bank fraud, theft and cybercrime.

They want stronger, dedicated, policing.

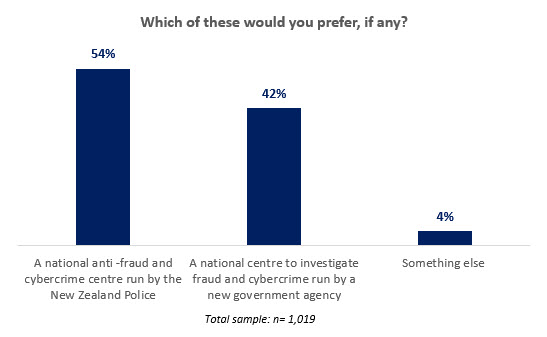

54% (2,220,000 adults) said they would prefer a national anti -fraud and cybercrime centre run by the New Zealand Police.

42% (1,725,000 adults) said they would prefer a national centre to investigate fraud and cybercrime run by a new government agency.

They also mostly want the banks and government to fund efforts to investigate and prosecute bank fraud and cybercrime:

- 75% (3,100,000 adults) believed banks should fund efforts to investigate and prosecute bank fraud and cybercrime.

- 70% (2,884,000 adults) said it should be the government.

Support for national and bank identity systems

Respondents to the survey were told:

Some argue that New Zealand has poor scam defences because the country does not have a national digital identity system. They say this would allow people – and others – to prove their identities.

Others argue that a national digital identity system might pose a risk to personal freedoms.

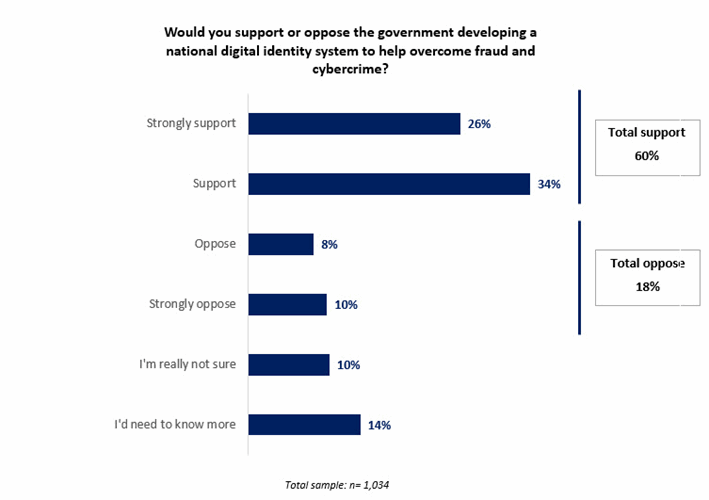

60% (2,447,000 adults) support the government developing a digital identity system to help overcome fraud and cybercrime.

18% (718,000 adults) oppose a digital identity system.

24% (961,000 adults) were either unsure or needed to know more about a digital identity system.

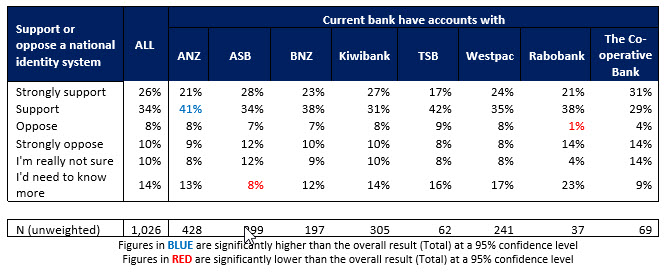

Highest support for a national identity system comes from ANZ (63%) and ASB (62%) customers.

Support for banks developing digital IDs

Respondents were told:

New Zealand has now passed the Digital Identity Services Trust Framework. The Framework will establish rules to protect the privacy and security of people’s information when it is shared within the trusted environment. The framework will not be compulsory, and will prioritise user permission for all actions.

This should allow private businesses, like banks, to offer digital identity services. So far none have been created.

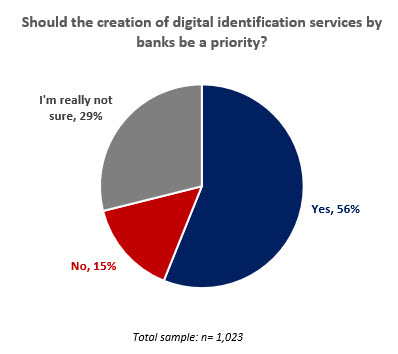

56% (2,315,000 adults) believe the creation of digital identification services by banks should be a priority.

People with higher incomes are more likely to think that a digital identification service should be prioritised by banks.

- Household income between $100k-$150k - 65%

- Household income above $150k - 70%

- Personal income above $150k - 78%

There are few significant differences across banks’ customers or by age.

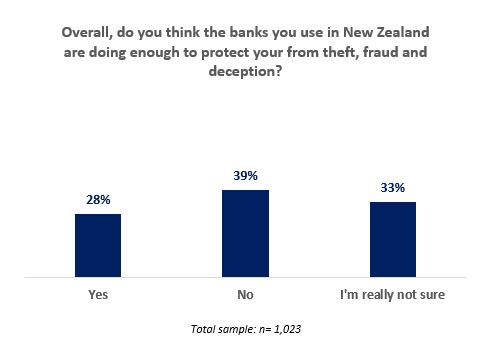

Are banks doing enough?

28% only think banks are doing enough to protect them

39% (1,600,000 adults) believe banks are not doing enough to protect from theft, fraud and deception.

Younger customers are more likely to think that banks are doing enough to protect them from theft, fraud and deception.

45% of customers aged 55+ think banks are not doing enough.

52% of households with annual incomes above $150k believe banks are not doing enough to protect them form fraud, theft and deception.

TSB and Rabobank customers think are more likely to think their bank is not doing enough to protect them from theft, fraud and deception.

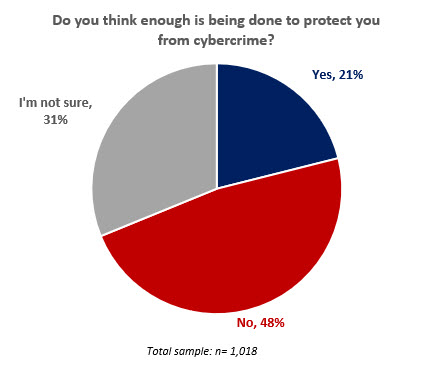

Not enough protection from cybercrime

Respondents were also asked if enough was being done to protect them from cybercrime.

21% (871,000 adults) said enough was being done.

48% (1,972,000 adults) said not enough was being done.

At 32%, people under 35 years believe enough is being done to protect them from cybercrime.

12% of people aged 55+ believe enough is being done.

Higher income respondents are more likely to believe that not enough is being done to protect from cybercrime.

58% of household more than $150k, a significant increase from 40% when the same question was asked in August 2023.

Methodology and sample

Results are from a Horizon Research omnibus survey conducted between 22 to 26 March 2024.

The total sample size was 1,036 adults, 18 years of age and over.

Respondents were from Horizon’s two specialist online research panels (general and Māori populations 18+) and a third party research panel for source diversity.

The maximum margin of error is ±3% (at the 95% confidence level). The data was weighted on age, education, ethnicity, personal income and region to match the adult population.

The survey was conducted as part of Horizon's public-interest research programme.

FREE: download the survey report.

Contact

For more information about this survey, please contact:

- Julia Ord, Manager, Horizon Research Limited, mobile 027 706 8790, email Julia.ord@horizonresearch.co.nz or

- Graeme Colman, Principal, Horizon Research Limited, mobile 021 848 576, email gcolman@horizonresearch.co.nz.

HorizonPoll Online Survey system

and website developed by BEWEB

Copyright © 2010. HorizonPoll incorporating ShapeNZ - Listening to New Zealand